x No fee required

¨ Fee paid previously with preliminary materials

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

![[MISSING IMAGE: lg_petros-4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-142539/lg_petros-4clr.jpg)

August , 2023

To Our Stockholders:

On behalf of the Board of Directors (the “Board”) of Petros Pharmaceuticals, Inc. (the “Company,” “Petros,” “our” or “we”), I cordially invite you to attend our 2021 Annual Meetinga special meeting of Stockholdersstockholders (the “Annual“Special Meeting”) at 10 a.m. Eastern Time on Wednesday, December 22, 2021. In lightThursday, September 14, 2023. To provide access to our stockholders regardless of public health concerns regarding the coronavirus (“COVID-19”) outbreak,geographic location, this year’s AnnualSpecial Meeting will be held in a virtual-only meeting format at

Stockholders will be able to participate, vote electronically and submit questions during the Special Meeting. Details regarding the meeting, the business to be conducted at the AnnualSpecial Meeting and information about Petros that you should consider when you vote your shares are described in the accompanying Notice of AnnualSpecial Meeting of Stockholders (the “Notice”), the proxy statement (the “Proxy Statement”) and the proxy card. Also provided is the Company’s 2020 Annual Report, which includes our annual report on Form 10-K for the fiscal year ended December 31, 2020. We urge you to review the accompanying materialthese materials carefully and to promptly returnvote your shares electronically via the enclosedInternet or by completing and returning the proxy card or voting instruction form.form if you requested paper proxy materials. Our proxy statement and the 2020 Annual Report areProxy Statement is also available at

At the AnnualSpecial Meeting, five persons will be elected to our Board. In addition, we will ask stockholders to approve a proposed amendment to the Petros Pharmaceuticals, Inc. 2020 Omnibus Incentive Compensation Plan, as amended, to increase the aggregate number of shares available for the grant of awards by 1,521,654 shares, to a total of 2,600,000 shares of common stock and to ratify the appointment of EisnerAmper LLC as our independent registered public accounting firm for our fiscal year ending December 31, 2021. stockholders:

| 1. | To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock underlying shares of convertible preferred stock and warrants issued by us in a private placement in July 2023, in an amount equal to or in excess of 20% of our common stock outstanding before the issuance of such convertible preferred stock and warrants (including any amortization payments made to the holders of convertible preferred stock in the form of issuance of shares of common stock and upon the operation of anti-dilution provisions applicable to such convertible preferred stock and warrants in accordance with their terms) (the “Issuance Proposal”); |

| 2. | To approve a proposed amendment to the Amended and Restated Petros Pharmaceuticals, Inc. 2020 Omnibus Incentive Compensation Plan to increase the aggregate number of shares available for the grant of awards by 2,500,000 shares, to a total of 2,760,000 shares of common stock (the “Incentive Plan Amendment Proposal”); |

| 3. | To approve an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 150,000,000 to 250,000,000 and to make a corresponding change to the number of authorized shares of capital stock (the “Share Increase Proposal”); and |

| 4. | To approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal, the Incentive Plan Amendment Proposal or the Share Increase Proposal. |

The Board recommends the approval of each of these threefour proposals. Such other business will be transacted as may properly come before the AnnualSpecial Meeting.

We hope you will be able to attend the AnnualSpecial Meeting. Whether you plan to attend the AnnualSpecial Meeting or not, your vote is important. We encourage you to signvote your shares electronically via the Internet or by completing and return the enclosedreturning your proxy card or use Internet votingif you requested paper proxy materials prior to the AnnualSpecial Meeting, in order for your shares to be represented and voted at the AnnualSpecial Meeting. If your shares are held in the name of a broker, trust, bank or other nominee, and you receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the AnnualSpecial Meeting.

We urge you to read the accompanying Notice and Proxy Statement carefully and vote in accordance with the Board’s recommendations on all proposals.

Thank you for your continued support of Petros Pharmaceuticals, Inc. We look forward to seeing you at the AnnualSpecial Meeting.

Sincerely,

| John D. Shulman, | |

| Executive Chairman of the Board |

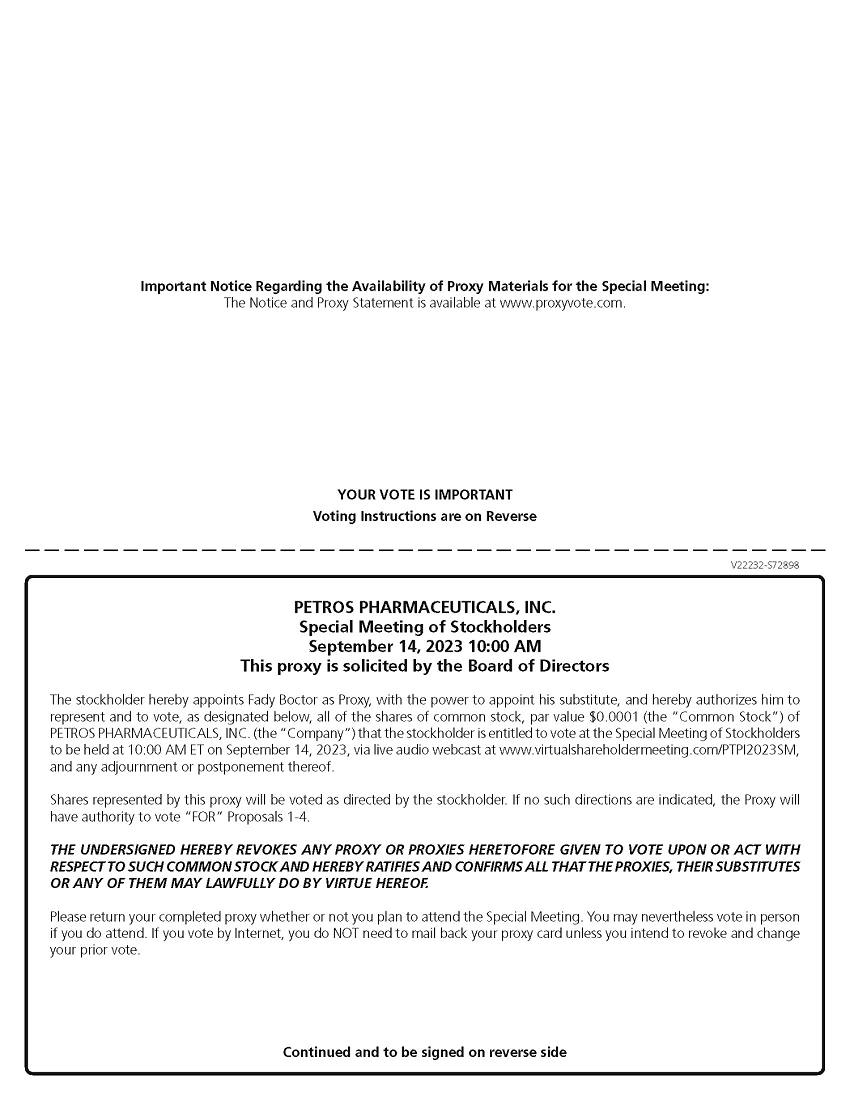

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON ThUrSDAY, September 14, 2023:

Our official Notice of Special Meeting of Stockholders and Proxy Statement are available at: www.proxyvote.com.

John D. Shulman,Executive ChairmanNotice of the BoardSpecial Meeting of Stockholders of

Petros Pharmaceuticals, Inc.

August , 2023

TIME: 10 a.m. Eastern Time

DATE:

PLACE:

Purposes:

| 1. | To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock underlying shares of convertible preferred stock and warrants issued by us in a private placement in July 2023, in an amount equal to or in excess of 20% of our common stock outstanding before the issuance of such convertible preferred stock and warrants (including any amortization payments made to the holders of convertible preferred stock in the form of issuance of shares of common stock and upon the operation of anti-dilution provisions applicable to such convertible preferred stock and warrants in accordance with their terms) (the “Issuance Proposal”); |

| 2. | To approve a proposed amendment to the Amended and Restated Petros Pharmaceuticals, Inc. 2020 Omnibus Incentive Compensation Plan to increase the aggregate number of shares available for the grant of awards by 2,500,000 shares, to a total of 2,760,000 shares of common stock (the “Incentive Plan Amendment Proposal”); |

| 3. | To approve an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 150,000,000 to 250,000,000 and to make a corresponding change to the number of authorized shares of capital stock (the “Share Increase Proposal”); |

| 4. | To approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal, the Incentive Plan Amendment Proposal or the Share Increase Proposal (the “Adjournment Proposal”); and |

| 5. | To transact such other business that is properly presented at the Special Meeting and any adjournments or postponements thereof. |

Stockholders are referred to the Proxy Statement for more detailed information with respect to the matters to be considered at the AnnualSpecial Meeting. After careful consideration,

Who May Vote:

Only stockholders of record as of the close of business on November 18, 2021August 16, 2023 (the “Record Date”) are entitled to receive notice of and to vote at the AnnualSpecial Meeting and any adjournments or postponements of the meeting. You will be able to participate in the virtual AnnualSpecial Meeting online and vote your shares electronically and submit questions during the meeting and stockholders of record may view the list of registered holders entitled to vote at the meeting. You will not be able to attend the AnnualSpecial Meeting in person.

To virtually attend the AnnualSpecial Meeting, you must be a stockholder of record or beneficial owner as of the close of business on the Record Date. You will be able to virtually attend and participate in the AnnualSpecial Meeting by visiting

All stockholders are cordially invited to attend the AnnualSpecial Meeting. A complete list of registered stockholders entitled to vote at the AnnualSpecial Meeting will be available for examination during normal business hours for ten (10) calendar days before the AnnualSpecial Meeting at our address above. To the extent office access is impracticable, due to the recent COVID-19 pandemic, you may contact Fady Boctor at (973) 242-0005 for alternative arrangements to examine the stockholder list. The email should state the purpose of the request and provide proof of ownership of our voting securities as of the close of business on the Record Date. The stockholder list will also be available online during the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

John D. Shulman,

Executive Chairman of the Board

TABLE OF CONTENTSTable of Contents

| 3 | ||||||||

| A-1 | ||||||||

| B-1 |

Petros Pharmaceuticals, Inc.

1185 Avenue of the Americas, 3rd Floor

New York, NY 10036

Proxy Statement for the

Petros Pharmaceuticals, Inc.

Special Meeting of Stockholders

to be Held on September 14, 2023

This Proxy Statement, along with the accompanying noticeNotice of the 2021 AnnualSpecial Meeting of Stockholders, contains information about the 2021 AnnualSpecial Meeting of Petros Pharmaceuticals, Inc., including any adjournments or postponements thereof. We are holding the AnnualSpecial Meeting at 10 a.m. Eastern Time, on Wednesday, December 22, 2021,Thursday, September 14, 2023, in virtual format at

In this Proxy Statement, we refer to Petros Pharmaceuticals, Inc. as “Petros,” “the Company,” “we” and “us.”

This Proxy Statement relates to the solicitation of proxies by our Board of Directors for use at the AnnualSpecial Meeting.

On or about November 22, 2021,August , 2023, we began sending proxy materials to stockholders entitled to vote at the AnnualSpecial Meeting.

IMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS FOR THESTOCKHOLDER ANNUALSpecial MEETING of Stockholders

TO BE HELD ON DECEMBER 22, 2021September 14, 2023

This Proxy Statement and our Notice of AnnualSpecial Meeting of Stockholders and our 2020 Annual Report on Form 10-K are available for viewing, printing and downloading at

The executive offices of the Company are located at, and the mailing address of the Company is, 1185 Avenue of the Americas, 3rd Floor, New York, NY 10036.

At the 2021 Annual Meetingspecial meeting of Stockholders,stockholders to be held on Thursday, September 14, 2023 (the “Special Meeting”), the Company expects the following matters to be acted upon:

| 1. | The authorization, for purposes of complying with Nasdaq Listing Rule 5635(d), of the issuance of shares of our common stock underlying shares of convertible preferred stock and warrants issued by us in a private placement in July 2023, in an amount equal to or in excess of 20% of our common stock outstanding before the issuance of such convertible preferred stock and warrants (including any amortization payments made to the holders of convertible preferred stock in the form of issuance of shares of common stock and upon the operation of anti-dilution provisions applicable to such convertible preferred stock and warrants in accordance with their terms) (the “Issuance Proposal”); |

| 2. | The approval of a proposed amendment to the Amended and Restated Petros Pharmaceuticals, Inc. 2020 Omnibus Incentive Compensation Plan to increase the aggregate number of shares available for the grant of awards by 2,500,000 shares, to a total of 2,760,000 shares of common stock (the “Incentive Plan Amendment Proposal”); |

| 3. | The approval of an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of common stock from 150,000,000 to 250,000,000 and to make a corresponding change to the number of authorized shares of capital stock (the “Share Increase Proposal”); |

| 4. | The approval of a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal, the Incentive Plan Amendment Proposal or the Share Increase Proposal (the “Adjournment Proposal”); and |

| 5. | The transaction such other business that is properly presented at the Special Meeting and any adjournments or postponements thereof. |

The Board unanimously recommends that you vote “For” items 1, 2, 3, and 4, and “FOR” for the option of “every year” for Proposal 5 above

Disclosures in this proxy statement may contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements are based upon management’s assumptions, expectations, projections, intentions and beliefs about future events. Except for historical information, the use of predictive, future-tense or forward-looking words such as “intend,” “plan,” “predict,” “may,” “will,” “project,” “target,” “strategy,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “forecast,” “should” and similar expressions, whether in the negative or affirmative, that reflect our current views with respect to future events and operational, economic and financial performance are intended to identify such forward-looking statements. Such forward-looking statements are only predictions, and actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of risks and uncertainties, including, without limitation, Petros’ ability to execute on its business strategy, including its plans to develop and commercialize its product candidates; Petros’ ability to comply with obligations as a public reporting company; Petros’ ability to maintain compliance with the listing standards of The Nasdaq Stock Market (“Nasdaq”); the ability of Petros to timely and effectively implement controls and procedures required by Section 404 of the Sarbanes-Oxley Act of 2002; the risk that the financial performance of Petros may not be as anticipated by the merger transactions that resulted in the Company’s creation; risks resulting from Petros’ status as an emerging growth company, including that reduced disclosure requirements may make shares of Petrosour common stock, par value $0.0001 per share (the “Common Stock”) less attractive to investors; ; Petros’ ability to continue as a going concern; risks related to Petros’ history of incurring significant losses; risks related to Petros’ dependence on the commercialization of a single product, Stendra®, and on a single distributor thereof; risks related to the termination of Petros’ commercial supply agreement with Vivus, including the risk that Petros may not be able to obtain sufficient quantities of Stendra® in a timely manner or on commercially viable terms;; risks related to Petros’ ability to obtain regulatory approvals for, or market acceptance of, any of its products or product candidates; and the expected or potential impact of the novel coronavirus (“COVID-19”) pandemic, including the emergence of new variants,public health emergencies, such as the Delta variant,COVID-19 pandemic, and the related responses of governments, consumers, customers, suppliers, employees and the Company, on our business, operations, employees, financial condition and results of operations. Additional factors that could cause actual results to differ materially from the results anticipated in these forward-looking statements are described in the Company’s quarterly reports on Form 10-Q, in “Risk Factor Summary” and in Part I, Item 1A., “Risk Factors,” in the Company’s Annual Report on Form 10-K for the year ended December 31, 20202022 and in our other reports filed with the Securities and Exchange Commission (the “SEC”).SEC. We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our annual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K. Petros cautions readers that the forward-looking statements included in, or incorporated by reference into, this proxy statement represent our beliefs, expectations, estimates and assumptions only as of the date hereof and are not intended to give any assurance as to future results. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, Petros cannot assess the effect of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in, or incorporated by reference into, this proxy statement to reflect any new information or future events or circumstances or otherwise, except as required by the federal securities laws.

Why is the Company Soliciting My Proxy?

The Board of Directors (the “Board”) of Petros Pharmaceuticals, Inc. is soliciting your proxy to vote at the 2021 annuala special meeting of stockholders to be held on Wednesday, December 22, 2021Thursday, September 14, 2023 at 10 a.m. Eastern Time, virtually at

Who Can Vote?

Only stockholders who owned our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (collectively, the “proxy materials”), because you owned shares of the Company’s common stockCommon Stock as of the close of business on November 18, 2021August 16, 2023 (the “Record Date”). The Company intends to commence distribution of the proxy materials to stockholders on or about November 22, 2021.

You do not need to attend the AnnualSpecial Meeting to vote your shares. Shares represented by valid proxies, received in time for the AnnualSpecial Meeting and not revoked prior to the AnnualSpecial Meeting, will be voted at the AnnualSpecial Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stockCommon Stock that you own entitles you to one vote.

What is the purposePurpose of the annual meeting?

At the AnnualSpecial Meeting, stockholders will consider and vote upon the following matters:

| · | Proposal 1: To authorize, for purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of shares of our common stock underlying shares of convertible preferred stock and warrants issued by us in a private placement in July 2023, in an amount equal to or in excess of 20% of our common stock outstanding before the issuance of such convertible preferred stock and warrants (including any amortization payments made to the holders of convertible preferred stock in the form of issuance of shares of common stock and upon the operation of anti-dilution provisions applicable to such convertible preferred stock and warrants in accordance with their terms) (the “Issuance Proposal”); |

| · | Proposal 2: To approve a proposed amendment to the Amended and Restated Petros Pharmaceuticals, Inc. 2020 Omnibus Incentive Compensation Plan to increase the aggregate number of shares available for the grant of awards by 2,500,000 shares, to a total of 2,760,000 shares of common stock (the “Incentive Plan Amendment Proposal”); |

| · | Proposal 3: To approve an amendment to our Amended and Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock from 150,000,000 to 250,000,000 and to make a corresponding change to the number of authorized shares of capital stock (the “Share Increase Proposal”); |

| · | Proposal 4: To approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Issuance Proposal, the Incentive Plan Amendment Proposal or the Share Increase Proposal (the “Adjournment Proposal”); and |

| · | To consider and act upon any other business as may properly come before the Special Meeting or any postponement or adjournment thereof. |

How doDo I vote?

Whether you plan to attend the AnnualSpecial Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive, and that are not revoked, will be voted in accordance with your

By Internet.

If you are a stockholder of record, you may submit your proxy by going to www.proxyvote.com and following the instructions includedprovided in the Notice or on your proxy card. If your shares are held with a broker, you will need to go to the website provided on your Notice or voting instruction card. Have your Notice, proxy card or voting instruction card in hand when you access the voting website. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can also request electronic delivery of future proxy card to vote by Internet.materials. Internet voting for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on December 21, 2021.

By mail.

You can vote by mail by completing, signing, dating and returning your proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the Board’s recommendations as noted below.

Virtually at the meeting.

You will also be able to vote your shares electronically by participating in the virtual AnnualSpecial Meeting. To participate in the virtual AnnualSpecial Meeting, you will need the control number included on your proxy card (if you requested paper materials) or on the instructions that accompanied your proxy materials.

If your shares are held in “street name” (held(held in the name of a bank, broker, nominee or other holder of record), you will receive instructions from the holder of record. You must follow the instructions provided to you by the holder of record in order for your shares to be voted. Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to virtually vote your shares at the AnnualSpecial Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card in order to vote.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

| · | “FOR” the Issuance Proposal; |

| · | “FOR” the Incentive Plan Amendment Proposal; |

| · | “FOR” the Share Increase Proposal; and |

| · | “FOR” the Adjournment Proposal. |

What happensHappens if additional mattersAdditional Matters are presentedPresented at the AnnualSpecial Meeting?

If any other matter is presented at the AnnualSpecial Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with their best judgment. At the time this Proxy Statement was first made available, we knew of no matters to be acted on at the AnnualSpecial Meeting, other than those discussed in this Proxy Statement.

May I Change or Revoke My Proxy?

You may change or revoke your proxy at any time before polls close at the AnnualSpecial Meeting. You may change or revoke your proxy in any one of the following ways:

| · | if you submitted a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above, or by voting by Internet on a date later than the prior proxy; |

| · | by notifying the Company in writing before the Special Meeting that you have revoked your proxy no later than 5:00 p.m. Eastern Time on September 11, 2023; or |

| · | by attending the virtual Special Meeting and voting electronically. Attending the virtual Special Meeting will not in and of itself revoke a previously submitted proxy. |

Your most current vote, whether by Internet, proxy card or at the AnnualSpecial Meeting is the one that will be counted.

What if I Receive More Than One Notice, Proxy Statement and Proxy Card?

You may receive more than one Notice, Proxy Statement, proxy card or voting instruction card if you hold shares of our common stockCommon Stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 3) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Annual Meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Therefore, if you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote on Proposals 1, 2, 4,the Issuance Proposal, the Incentive Plan Amendment Proposal, the Share Increase Proposal, or 5,the Adjournment Proposal, no votes will be cast on these proposalssuch proposal on your behalf. If you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for the election of directors or on the amendment to the 2020 Plan.any proposal.

What Constitutes a Quorum for the AnnualSpecial Meeting?

The presence, by virtual attendance or by proxy, of the holders of a majorityone third in number of the total outstanding stock issued and entitled to vote at the AnnualSpecial Meeting, is necessary to constitute a quorum at the AnnualSpecial Meeting. Votes of stockholders of record who are present at the AnnualSpecial Meeting by virtual attendance or by proxy, abstentions and broker non-votes are counted for purposes of determining whether a quorum exists.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Assuming the presence of a quorum:

| Proposal 1: |

| Issuance Proposal | The affirmative vote of the holders of a majority of the stock having voting power present in person or represented by proxy is required to approve the | ||||

| Proposal | The affirmative vote of the holders of a majority of the stock having voting power present in person or represented by proxy is required to approve |

| Proposal 3: the | The affirmative vote of the | |||

| Proposal 4: the Adjournment Proposal | The affirmative vote of the holders of a majority of the stock having voting power present in person or represented by proxy is required to approve the Adjournment Proposal. “ABSTAIN” votes will have the same effect as votes cast “AGAINST” the Adjournment Proposal. Because the Adjournment Proposal is not considered a routine matter, your bank, broker, trustee or other nominee, as the case may be, will not be able to vote your shares without your instruction with respect to the Adjournment Proposal. As a result, the failure to instruct your bank, broker, trustee or other nominee as to how to vote on the Share Increase Proposal will result in a such broker non-vote, which will have no effect on the results of this |

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, Philadelphia Stock Transfer,Broadridge Financial Solutions, Inc., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or otherwise provide.

Who countsCounts the votes?

All votes will be tabulated by Philadelphia Stock Transfer,Broadridge Financial Solutions, Inc., the inspector of election appointed for the AnnualSpecial Meeting. Each proposal will be tabulated separately.

Where Can I Find the Voting Results of the AnnualSpecial Meeting?

The preliminary voting results will be announced at the AnnualSpecial Meeting, and we will publish the voting results in a Current Report on Form 8-K (the “Form 8-K”), which we expect to file with the SEC within four business days of the AnnualSpecial Meeting. If final results are unavailable when we file the Form 8-K, then we will file an amendment to the Form 8-K to disclose the final voting results within four business days after the final voting results are known.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to our stockholders with respect to any of the proposals described above to be brought before the AnnualSpecial Meeting.

What Are the Costs of Soliciting these Proxies?

Our Board is asking for your proxy and we will pay all of the costs of soliciting these proxies. In addition, our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

Attending the AnnualSpecial Meeting

The AnnualSpecial Meeting will be held at 10 a.m. Eastern Time on Wednesday, December 22, 2021,Thursday, September 14, 2023, virtually at

The meeting webcast is expected to begin promptly at 10 a.m. Eastern Time on December 22, 2021.September 14, 2023. Online access will begin at 9:45 a.m. Eastern Time, and we encourage you to access the meeting prior to the start time. If you require technical support, please visit

Householding of Annual Disclosure Documents

Pursuant to SEC rules, either us or your bank, broker or other nominee will send a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your bank, broker or other nominee believe that the stockholders are members of the same family. This practice, referred

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of the Company’s proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Company stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

| 1. | If your shares of the Company are registered in your own name, please contact our transfer agent, Pacific Stock Transfer Co., and inform them of your request by calling them at +1 (800) 785-7782 or writing them at 6725 Via Austi Parkway, Suite 300, Las Vegas, Nevada 89119. |

| 2. | If a bank, broker or other nominee holds your shares of the Company, please contact the bank, broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number. |

Electronic Delivery of Company Stockholder Communications

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail. You can choose this option and save the Company the cost of producing and mailing these documents by following the instructions provided on your proxy card.

Who can help answer my questions?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this proxy statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this proxy statement. If you have any questions, or need additional material, please feel free to contact Fady Boctor, at (215) 370-6927.

The following table sets forth information with respect to the beneficial ownership of our common stockCommon Stock as of the Record Date, by (i) each stockholder known by us to be the beneficial owner of more than 5% of our common stock,Common Stock, (ii) each of our directors and named executive officers, and (iii) all of our directors and executive officers as a group. Unless otherwise noted, the address for each person named in the table is c/o Petros Pharmaceuticals, Inc., 1185 Avenue of the Americas, 3rd Floor, New York, NY 10036.

| Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Class(2) | | ||||||

Juggernaut Capital Partners III GP, Ltd.(3) | | | | | 6,769,578 | | | | | | 45.63% | | |

Bruce T. Bernstein(4) | | | | | 57,483 | | | | | | * | | |

Greg Bradley(5) | | | | | 25,000 | | | | | | * | | |

John Shulman(6) | | | | | 6,769,578 | | | | | | 45.63% | | |

Joshua N. Silverman(7) | | | | | 163,130 | | | | | | 1.23% | | |

Wayne R. Walker(8) | | | | | 25,000 | | | | | | * | | |

Fady Boctor(9) | | | | | 107,835 | | | | | | * | | |

Mitch Arnold(10) | | | | | 16,169 | | | | | | * | | |

Andrew Gesek(11) | | | | | 25,097 | | | | | | * | | |

Greg Ford(12) | | | | | 2,925 | | | | | | * | | |

Keith Lavan(13) | | | | | 976 | | | | | | * | | |

| All directors and executive officers as a group | | | | | 7,189,292 | | | | | | 48.79% | | |

| Name and Address of Beneficial Owner | Nature of Beneficial Ownership(1) | of Class(2) | |||||

| Intracoastal Capital LLC(4) | 167,139 | ||||||

| Bruce T. Bernstein(5) | 13,346 | ||||||

| Greg Bradley(6) | 13,314 | ||||||

| John Shulman(7) | 789,969 | ||||||

| Joshua N. Silverman(8) | |||||||

| Wayne R. Walker(9) | 13,315 | ||||||

| Fady Boctor(10) | 21,566 | ||||||

| Mitch Arnold(11) | 5,117 | ||||||

| Andrew Gesek(12) | 10 | ||||||

| All directors and executive officers as a group | 872,864 |

| * | Less than one percent. |

| (1) | Beneficial ownership is determined in accordance with the rules of the | ||||||

| (2) | A total of shares of our Common Stock are considered to be outstanding pursuant to SEC Rule 13d-3(d)(1) as of the Record Date. |

| Amount consists of (1) 8,346 shares of common stock and (2) 5,000 shares underlying stock options held by Mr. Bernstein that were vested as of the Record Date or will vest within 60 days thereafter. |

| (6) | Amount consists of (1) 8,314 shares of common stock and (2) 5,000 shares underlying stock options held by Mr. Bradley that were vested as of the Record Date or will vest within 60 days thereafter. |

| (7) | John Shulman is the sole shareholder and director of JCP III GP Ltd. Refer to note 3 for further information. Mr. Shulman’s address is 5301 Wisconsin Avenue NW, Suite 570, Washington, DC 20015. |

| (8) | Amount consists of (1) 11,237 shares of common stock and (2) 5,000 shares underlying stock options held by Mr. Silverman that were vested as of the Record Date or will vest within 60 days thereafter. |

| (9) | Amount consists of (1) 8,314 shares of common stock and (2) 5,000 shares underlying stock options held by Mr. Walker that were vested as of the Record Date or will vest within 60 days thereafter. |

| (10) | Amount consists of 21,566 shares underlying stock options held by Mr. Boctor |

The Board is responsible for evaluating and approving the compensation of executive officers. The major elements of Petros’ compensation program include:

retirement benefits through a qualified defined contribution scheme (such as a 401(k) plan in the United States); and |

| ● | other benefit programs generally available to all U.S. and non-U.S. employees that are customary and appropriate for the country in which the employee is operating. |

Petros’ Compensation Objectives

| Description | Performance/ Job Considerations | Primary Objectives | ||||||||

| Base Salary | Fixed cash amount. | Increases based upon individual performance against goals, objectives and job criteria such as executive qualifications, responsibilities, role criticality, potential and market value. | Recruit qualified executives or personnel. Retention of personnel. | |||||||

| Cash Incentive Opportunity | Short-term incentive, annual bonus opportunities. | Amount of actual payment based on achievement of corporate financial goals, key strategic and operating objectives. | Promote achievement of short-term financial goals and strategic and operating objectives. | |||||||

| Retirement and Welfare Benefits | 401(k) plan, health and insurance benefits. | None, benefits offered to broad workforce. | Recruit qualified employees. |

Petros provides base salary based on the executive officers’ individual responsibilities and performance. Petros offers bonus opportunities to certain executive officers and employees based primarily on company performance. See “Employment Agreements” below. Petros’ compensation decisions and salary adjustments are generally evaluated on a calendar year basis.

The Compensation Committee of the Board (the “Compensation Committee”) is responsible for determining executive compensation.

Summary Compensation Table

The following table shows compensation awarded to, paid to or earned by, (1) Petros’ principal executive officer, (2) Petros’ most highly compensated executive officer other than the Company’s principal executive officer and principal accounting officer and(3) up to two individuals who would have qualified as one of Petros’ two other most highly compensated executive officers other than the principal executive officer but for the fact that the individual was not serving as an executive officer of the Company at the end of the last completed fiscal year; during the fiscal years ended December 31, 20202022 and 2019. (collectively, the “named executive officers”).

| Non-equity | |||||||||||||||||||||

| Incentive Plan | |||||||||||||||||||||

| Option | Compensation | All Other | |||||||||||||||||||

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Awards ($) (1) | ($) | Compensation($) (2) | Total ($) | ||||||||||||||

| Fady Boctor | 2022 | 350,000 | 280,000 | — | — | 52,209 | 682,209 | ||||||||||||||

| President and Chief Commercial Officer | 2021 | 350,000 | 125,000 | 658,340 | — | 44,481 | 1,177,821 | ||||||||||||||

| Mitchell Arnold | 2022 | 288,750 | 60,000 | — | — | 58,264 | 407,014 | ||||||||||||||

| Vice President of Finance and Chief Accounting Officer | 2021 | 262,500 | 50,000 | 131,659 | — | 53,424 | 497,584 | ||||||||||||||

| Andrew Gesek(3) | 2022 | 128,750 | — | — | — | 7,046 | 135,796 | ||||||||||||||

| Former President, Timm Medical | 2021 | 300,000 | — | 197,489 | — | 47,899 | 545,388 | ||||||||||||||

| (1) | For awards of stock options, the aggregate grant date fair value is computed based on the Black-Scholes option pricing model using the fair value of the underlying shares at the measurement date. |

| (2) | Amounts in this column reflect 401(k) contributions, insurance premiums (life, long term disability, short term disability, health, dental, and vision), and, for Mr. Arnold, car allowances. For 2022, this represents: for Mr. Boctor, $11,911 for contributions under Metuchen’s 401(k) plan and $40,298 of insurance premiums; for Mr. Arnold, $10,135 for contributions under Metuchen’s 401(k) plan and $48,129 of insurance premiums; and for Mr. Gesek, $1,618 for contributions under Metuchen’s 401(k) plan and $5,428 of insurance premiums. For 2021, this represents: for Mr. Boctor, $8,578 for contributions under Metuchen’s 401(k) plan and $35,903 of insurance premiums; for Mr. Arnold, $10,066 for contributions under Metuchen’s 401(k) plan and $43,358 of insurance premiums; and for Mr. Gesek, $9,135 for contributions under Metuchen’s 401(k) plan and $38,764 of insurance premiums. |

| Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($)(1) | | | Non-equity Incentive Plan Compensation ($)(2) | | | All Other Compensation ($)(3) | | | Total ($) | | ||||||||||||||||||

| Fady Boctor | | | | | 2020 | | | | | | 275,725 | | | | | | 125,000 | | | | | | — | | | | | | 67,125 | | | | | | 467,850 | | |

| President and Chief Commercial Officer | | | | | 2019 | | | | | | 208,333 | | | | | | 50,000 | | | | | | — | | | | | | 81,412 | | | | | | 339,745 | | |

| Mitchell Arnold | | | | | 2020 | | | | | | 236,250 | | | | | | 50,000 | | | | | | — | | | | | | 68,384 | | | | | | 354,634 | | |

| Vice President of Finance and Chief Accounting Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||

| Andrew Gesek | | | | | 2020 | | | | | | 270,000 | | | | | | 75,000 | | | | | | — | | | | | | 62,423 | | | | | | 407,423 | | |

| President, TIMM Medical | | | | | 2019 | | | | | | 300,000 | | | | | | — | | | | | | 234,688 | | | | | | 70,250 | | | | | | 604,937 | | |

Greg Ford(4) | | | | | 2020 | | | | | | 186,630 | | | | | | — | | | | | | — | | | | | | 66,070 | | | | | | 252,700 | | |

| Chief Executive Officer | | | | | 2019 | | | | | | 367,744 | | | | | | — | | | | | | — | | | | | | 82,655 | | | | | | 450,399 | | |

Keith Lavan(5) | | | | | 2020 | | | | | | 316,856 | | | | | | 50,000 | | | | | | — | | | | | | 95,602 | | | | | | 462,458 | | |

| Chief Financial Officer | | | | | 2019 | | | | | | 335,297 | | | | | | — | | | | | | — | | | | | | 78,005 | | | | | | 413,302 | | |

| (3) | Mr. Gesek resigned from his position as President of Timm Medical Technologies, Inc., a wholly-owned subsidiary of the Company, effective February 28, 2022. |

Employment Agreements

Fady Boctor

On January 24, 2019, the Company provided an offer letter to Mr. Boctor. The offer letter provided for Mr. Boctor’s at-will employment and set forth his initial base salary as $250,000 per annum ($208,333 was paid pro-rata based on his start date of March 1, 2019), a signing bonus of $50,000, eligibility for an annual

On December 11, 2020 and in connection with the commencement of Mr. Fady Boctor’s employment as the President and Chief Commercial Officer of Petros, the Company and Mr. Boctor entered into a Bonus Agreement (the “Bonus Agreement”), pursuant to which Petros agreed to award Mr. Boctor a bonus in the amount of $125,000 payable on December 15, 2020. The Bonus Agreement provides that in the event that Mr. Boctor iswas not employed by Petros on June 11, 2022, he shall bewould have been obligated to repay such amount to Petros, unless his employment was terminated by Petros without “Cause” or by Mr. Boctor for “Good Reason” as such terms are defined in the Bonus Agreement.

Effective as of February 19, 2021, the Company entered into an employment offer letter (the “Employment Offer Letter”) with Mr. Boctor, pursuant to which, Mr. Boctor will serve in an “at-will” capacity, at an initial base salary of $350,000 per annum. Mr. Boctor received a signing bonus in the amount of $250,000 (the “Signing Bonus”), payable in two equal installments of $125,000 each, the first of which was paid to Mr. Boctor in December 2020, and the second of which was paid to Mr. Boctor on May 15, 2021, provided that Mr. Boctor remainsremained employed with the Company on such date. The Employment Offer Letter providesprovided that in the event that Mr. Boctor doesdid not remain employed by Petros on May 1, 2022, he shall bewould have been obligated to repay to Petros the Signing Bonus, unless his employment was terminated by Petros without “Cause” or by Mr. Boctor for “Good Reason” as such terms are defined in the Employment Offer Letter. Additionally, commencing in calendar year 2021, Mr. Boctor is eligible to earn an annual cash bonus (the “Annual Bonus”) in respect of each calendar year that ends during the term of his employment, to be earned based on the achievement of performance objectives determined in the discretion of the Compensation Committee. Each Annual Bonus is targeted at 100% of Mr. Boctor’s then-base salary. Mr. Boctor is entitled to participate in all employee benefit plans, policies, programs or privileges made available to similarly situated employees of Petros. The Employment Offer Letter contains customary restrictive covenants and confidentiality obligations and provides that Mr. Boctor will be subject to non-competition and non-solicitation covenants during the term of his employment with Petros and for a period of one-year following Mr. Boctor’s separation from the Company under any circumstances.

In consideration of entering into the Employment Offer Letter, Mr. Boctor was granted an option to purchase up to 215,66921,566 shares of the Company’s Common Stock, par value $0.0001 per share, at an exercise price of $3.74$37.40 per share (the “Options”). The Options vested 50% as of February 19, 2021, the date of grant, and the remainder shall vestvested in equal installments on the first and second anniversary thereof.

Andrew Gesek

On December 10, 2018, the Company entered into an employment agreement with Mr. Gesek, pursuant to which Mr. Gesek served as the Company’s Chief Operating Officer.Officer, until his resignation from the Company, effective February 28, 2022. Under his employment agreement, Mr. Gesek was entitled to an initial annual base salary of $300,000. Additionally, Mr. Gesek was eligible to receive a deferred cash signing bonus of $75,000 on January 15, 2019, an annual performance bonus with a target of up to 35% of his then-current base salary, contingent upon satisfaction of corporate performance goals, a retention bonus of $100,000 contingent upon satisfaction of corporate performance goals and Mr. Gesek’s continued employment with the Company as of the twelve (12) month anniversary of his start date, and an extension bonus of up to $75,000 payable in monthly installments between January and June 2020, contingent upon Mr. Gesek’s continued employment through June 30, 2020. The agreement also provided Mr. Gesek with the opportunity to earn ten percent (10%) of the net proceeds in excess of six million dollars ($6,000,000) of any sale of all or substantially all of Timm Medical Technologies or Pos-T-Vac, LLC or their constituent businesses, and to receive twenty percent (20%) of the gross profits (less direct expenses) of sales for the first twelve (12) months under a contract with the U.S. Department of Veterans Affairs, if he was able to secure such a contract in the first eighteen (18) months of the term of the employment agreement (the “VA Payment”).

Pursuant to Mr. Gesek’s employment agreement, upon termination of his employment without cause or his resignation for good reason (each as defined therein), Mr. Gesek would bewas entitled to receive (i) his salary, accrued vacation and PTO through the termination date, and (ii) the VA Payment, if he has submitted a bid prior to termination and a contract is entered into within six (6) months of his termination.

On March 1, 2022, in connection with Mr. Gesek’s

In exchange for the consideration provided to Mr. Gesek in the Severance Agreement, Mr. Gesek agreed to waive and release any claims he or his affiliates, successors or assigns may have against the Company and certain related persons and organizations, whether or not arising out of or related to Mr. Gesek’s employment with the Company or the termination thereof.

In connection with the execution of the Severance Agreement, Mr. Gesek’s employment agreement expired on June 30,and the Confidentiality and Inventions Assignment Agreement, dated January 27, 2020 were terminated; provided, however, that certain surviving customary confidentiality provisions and is no longerrelated covenants remain in effect exceptfull force and effect. The Severance Agreement also provides for certain provisions contemplated to survive termination. Ascustomary mutual covenants regarding confidentiality and non-disparagement.

Outstanding Equity Awards at 2022 Fiscal Year-End

The following table sets forth information concerning outstanding equity awards held by each of June 30, 2020, Mr. Gesek has been employed by the Companyour named executive officers as an “at-will” employee and the terms of his employment are not governed by a written agreement.

| Option awards | ||||||||||||||||||

| Number of | ||||||||||||||||||

| Number of | securities | |||||||||||||||||

| securities | underlying | |||||||||||||||||

| Vesting | underlying | unexercised | Option | |||||||||||||||

| Commencement | unexercised | options (#) | Exercise | Option | ||||||||||||||

| Name | date | options (#) exercisable | unexercisable | Price ($) | Exercise Date | |||||||||||||

| Fady Boctor | 2/19/2021 | 16,175 | 5,392 | $ | 37.40 | 2/19/2031 | ||||||||||||

| Mitchell Arnold | 5/11/2021 | 3,000 | 2,000 | $ | 32.10 | 5/11/2031 | ||||||||||||

Accounting and Tax Considerations

Section 162(m) of the Code places a limit of $1,000,000 on the amount of compensation that a public company may deduct as a business expense in any year with respect to such company’s chief executive officer, certain other named executive officers, and all “covered employees” as defined by Section 162(m). This deduction limitation did not previously apply to Metuchen as a private company.

The Company’s Compensation Committee intends to maximize deductibility of compensation under Section 162(m) to the extent practicable while maintaining a competitive, performance-based compensation program. However, the Company’s compensation committee reserves the right to award compensation which it deems to be in the Company’s best interest and in the best interest of its stockholders, but which may not be fully tax deductible under Code Section 162(m).

Employment Benefits Plans

Petros 401(k) Plan

Petros has a defined contribution retirement plan in which all employees are eligible to participate. This plan is intended to qualify under Section 401(k) of the Code so that contributions by employees and by Petros to the plan and income earned on plan contributions are not taxable to employees until withdrawn or distributed from the plan, and so that contributions, including employee salary deferral contributions, will be deductible by Petros when made. Petros currently provides contributions under this plan of up to six percent (6%) of an employee’s compensation, subject to statutory limits.

Participants may elect a salary deferral up to the statutorily prescribed annual limit for tax-deferred contributions and Metuchen may make contributions up to six percent (6%) of the participant’s compensation, subject to certain statutory limits.

Petros also contributes to medical, disability and other standard insurance plans for its employees.

Director Compensation

Program| Non-equity | ||||||||||||||||||||||||||||

| Fees | incentive | Nonqualified | ||||||||||||||||||||||||||

| earned or | Stock | Option | plan | deferred | All other | |||||||||||||||||||||||

| paid in | awards | awards | compensation | compensation | compensation | |||||||||||||||||||||||

| Name | cash ($) | ($) | ($)(1) | ($) | earnings ($) | ($) | Total ($) | |||||||||||||||||||||

| John D. Shulman (2) | — | — | — | — | — | — | — | |||||||||||||||||||||

| Joshua N. Silverman (3) | 200,000 | 80,000 | — | — | — | — | 280,000 | |||||||||||||||||||||

| Bruce T. Bernstein (4) | 48,000 | 72,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| Gregory Bradley (5) | 48,000 | 72,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| Wayne R. Walker (6) | 48,000 | 72,000 | — | — | — | — | 120,000 | |||||||||||||||||||||

| (1) | Based upon the number of options issued times Black–Scholes value. |

| (2) | As of December 31, 2022, Mr. Shulman had outstanding options representing the right to purchase 5,000 shares of the company’s common stock. |

| (3) | Includes $33,333 of fees earned but not paid in 2022. As of December 31, 2022, Mr. Silverman had outstanding options representing the right to purchase 5,000 shares of the company’s common stock and 9,239 RSUs of which 2,516 are fully vested. |

| Name | | | Fees earned or paid in cash ($) | | | Stock awards ($) | | | Option awards ($)(1) | | | Non-equity incentive plan compensation ($) | | | Nonqualified deferred compensation earnings ($) | | | All other compensation ($) | | | Total ($) | | |||||||||||||||||||||

| John D. Shulman | | | | | — | | | | | | — | | | | | | 159,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | 159,000 | | |

| Joshua N. Silverman | | | | | — | | | | | | — | | | | | | 159,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | 159,000 | | |

| Bruce T. Bernstein | | | | | — | | | | | | — | | | | | | 159,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | 159,000 | | |

| Gregory Bradley | | | | | — | | | | | | — | | | | | | 159,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | 159,000 | | |

| Wayne R. Walker | | | | | — | | | | | | — | | | | | | 159,000 | | | | | | — | | | | | | — | | | | | | — | | | | | | 159,000 | | |

| (4) | Includes $12,000 of fees earned but not paid in 2022. As of December 31, 2022, Mr. Bernstein had outstanding options representing the right to purchase 5,000 shares of the company’s common stock and 8,316 RSUs of which 2,265 are fully vested. |

| (5) | Includes $12,000 of fees earned but not paid in 2022. As of December 31, 2022, Mr. Bradley had outstanding options representing the right to purchase 5,000 shares of the company’s common stock and 8,316 RSUs of which 2,265 are fully vested. |

| (6) | Includes $12,000 of fees earned but not paid in 2022. As of December 31, 2022, Mr. Walker had outstanding options representing the right to purchase 5,000 shares of the company’s common stock and 8,316 RSUs of which 2,265 are fully vested. |

On April 8, 2021, in connection with the directors’ appointment to the Board upon the Company becoming an independent publicly traded company on December 1, 2020, the Company awarded each of the five directors an initial grant of options (the “Initial Grant”) to purchase 5,000 shares of common stock of the Company at an exercise price of $31.80 per share. The shares of common stock underlying the options vested 25% on the date of grant, 25% shall vest upon the six-month anniversary of the date of grant and the remainder vested in equal installments over the following four fiscal quarters. In addition, on April 8, 2021, the Company granted to four directors (excluding Mr. Shulman) an additional 9,311 RSUs, valued at $296,000, contingent upon the shareholders approving an increase in the 2020 Plan, which approval was granted at the annual meeting of shareholders held on December 22, 2021.

In the event of a Change in Control (as defined in the 2020 Plan), shares of common stock of the Company underlying each of the restricted stock units granted to any non-employee director and the Initial Grant, along with any other stock options or equity-based awards held by any non-employee director, either (i) shall be assumed by, or replaced with grants of comparable awards of, the surviving entity or (ii) will vest and become exercisable, as applicable, immediately prior to such Change in Control, unless otherwise provided in the applicable award agreement.

For theeach fiscal year, ending December 31, 2021, each non-employee director, other than the Chairman and Vice Chairman, will receive an annual cash retainer in the amount of $48,000, and the Vice Chairman will receive an annual cash retainer in the amount of $200,000 per year. For theeach fiscal year, ending December 31, 2021, (i) each non-employee director, other than the Chairman and the Vice Chairman, will be granted a number of restricted stock units calculated by dividing (a) $72,000 by (b) the per share grant date fair value of the closing price of our common stock as of the date of grant, and (ii) the Vice Chairman automatically will be granted a number of restricted stock units calculated by dividing (a) $80,000 by (b) the per share grant date fair value of the closing price of our common stock as of the date of grant. The shares of common stock underlying the annual grant of restricted stock units will automatically vest upon the 12-month12 month anniversary of the date of grant.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee consists of Mr. Silverman, as Chairman, Mr. Bernstein and Mr. Walker. No member of the Compensation Committee has been an officer or employee of the Company. None of our executive officers serves on the board of directors or compensation committee of a company that has an executive officer that serves on our Board or Compensation Committee.

27

Background and Description of Directors has nominated John D. Shulman, Joshua N. Silverman, Bruce T. Bernstein, Gregory BradleyProposal

The Private Placement

On July 13, 2023, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain accredited and Wayne R. Walker (collectively, the “Company Nominees”institutional investors (the “Investors”), for electionpursuant to which we agreed to sell to the Investors in a private placement (the “Private Placement”) (i) an aggregate of 15,000 shares (the “Preferred Shares”) of our newly-designated Series A Convertible Preferred Stock, with a par value of $0.0001 per share and a stated value of $1,000 per share (the “Preferred Stock”), initially convertible into up to 6,666,668 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) at an initial conversion price of $2.25 per share (as adjusted, the “Conversion Price”), and (ii) warrants (the “Investor Warrants”) to acquire up to an aggregate of 6,666,668 shares of Common Stock (the “Investor Warrant Shares”) at an initial exercise price of $2.25 per share (as adjusted from time to time, the “Exercise Price”). In connection with the Private Placement, we also entered into an Engagement Letter (the “Engagement Agreement”) with Katalyst Securities LLC (the “Placement Agent”), pursuant to which we agreed to issue to the Placement Agent or its designees warrants with substantially the same terms as the Investor Warrants (the “Placement Agent Warrants,” and together with the Investor Warrants, the “Warrants”) to purchase an aggregate of 533,334 shares of Common Stock (the “Placement Agent Warrant Shares,” and together with the Investor Warrant Shares, the “Warrant Shares”) at the Annual Meeting. If theyExercise Price.

The Conversion Price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then applicable Conversion Price (subject to certain exceptions). The Conversion Price may also be voluntarily reduced by the Company to any amount and for any period of time deemed appropriate by the Board at any time with the prior written consent of the holders of at least a majority of the outstanding Preferred Shares, subject to the rules and regulations of Nasdaq. We are elected, they will serverequired to redeem the Preferred Shares in 13 equal monthly installments, commencing on the earlier of (x) the first trading day of the calendar month which is at least 25 trading days after the date that the initial Registration Statement (as defined below) is declared effective by the SEC and (y) November 1, 2023. The amortization payments due upon such redemption are payable, at our Boardelection, in cash at 107% of Directors until the 2022 annual meetingInstallment Redemption Amount or subject to certain limitations, in shares of Common Stock valued at the lower of (i) the Conversion Price then in effect and (ii) the greater of (A) 80% of the average of the three lowest closing prices of the Company’s Common Stock during the thirty trading day period immediately prior to the date the amortization payment is due or (B) the lower of (x) $0.4484 and (y) 20% of the “Minimum Price” (as defined in Nasdaq Stock Market Rule 5635) on the date on which our stockholders approve this proposal (the “Stockholder Approval”) or, in any case, such lower amount as permitted, from time to time, by the Nasdaq Stock Market, and until their respective successorsin each case subject to adjustment for stock splits, stock dividends, stock combinations, recapitalizations or other similar events (the “Installment Conversion Price”), which amortization amounts are duly electedsubject to certain adjustments as set forth in the Certificate of Designations of the Preferred Stock (the “Certificate of Designations”). Further, the holders of the Preferred Shares are entitled to dividends of 8% per annum, compounded monthly, which is payable in cash or shares of Common Stock at our option. Upon conversion or redemption, the holders of the Preferred Shares are also entitled to receive a dividend make-whole payment assuming for calculation purposes that the stated value remained outstanding through and qualified, or until their earlier death, resignation or removal.

Rule 5635 of the Rules of the Nasdaq Stock Market requires that a listed company seek stockholder approval in certain circumstances, including prior to the issuance, in a transaction other than a public offering, of 20% or more of the company’s outstanding Common Stock or voting power outstanding before the issuance at a price that is less than the lower of (i) the Nasdaq Official Closing Price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement in connection with such transaction; or (ii) the average Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of such binding agreement (the “Minimum Price”). In connection with the Private Placement, we agreed to seek approval by our stockholders for the enclosed proxy will be voted “FOR”issuance of Underlying Shares. The Preferred Shares are convertible into up to 6,666,668 shares of our Common Stock at the electioninitial Conversion Price, and the Warrants are exercisable into up to 7,200,002 shares of each Company Nominee.our Common Stock at the initial Exercise Price. In the event that any nominee becomes unablethe Company in its sole discretion determines to make the accrued dividends and amortization payments in shares of Common Stock and the Installment Conversion Price is less than the Conversion Price, or unwillingthe Exercise Price is reduced due to serve, the anti-dilution provisions of the Warrants, the number of shares represented byof Common Stock to be issued would be greater than the enclosed proxynumber of shares at which the Preferred Shares or the Warrants are initially convertible or exercisable. In the event that the Company in its sole discretion determines to make the accrued dividends and amortization payments in shares of Common Stock and the price per share is equal to the Floor Price, and in the event that the Exercise Price is reduced to the Floor Price due to the anti-dilution provisions of the Warrants, the aggregate number of shares of Common Stock to issuable upon the conversion of the Preferred Stock and the exercise of the Warrants would be up to 76,387,283 shares, which number will be votedincreased if the Floor Price is reduced based on the Minimum Price on the date of the Stockholder Approval.

In connection with the Private Placement, we agreed to seek approval by our stockholders for the issuance of the Underlying Shares, including any amortization payments made to the holders of convertible preferred stock in the form of issuance of shares of common stock and upon the operation of anti-dilution provisions applicable to such convertible preferred stock and warrants in accordance with their terms.

Reasons for the Private Placement

As of June 30, 2023, our cash on hand totaled approximately $7,400,000. In July 2023, our Board determined that it was necessary to raise additional funds for general corporate purposes. We believe that the Private Placement, which yielded gross proceeds of approximately $15 million, was necessary in light of our cash and funding requirements. We also believe that the anti-dilution protections contained in the Certificate of Designations and Warrants were reasonable in light of market conditions and the size and type of the Private Placement, and that we would not have been able to complete the sale of the Preferred Shares and Warrants unless such anti-dilution provisions were offered. In addition, at the time of the Private Placement, our Board considered numerous alternatives to the transaction, none of which proved to be feasible or, in the opinion of our Board, would have resulted in aggregate terms equivalent to, or more favorable than, the terms obtained in the Private Placement.

Securities Purchase Agreement

On July 13, 2023, we entered into the Purchase Agreement with the Investors, pursuant to which we agreed to sell to the Investors (i) an aggregate of 15,000 Preferred Shares, initially convertible into up to 6,666,668 Conversion Shares at an initial Conversion Price of $2.25 per share and (ii) Investor Warrants to acquire up to an aggregate of 6,666,668 Warrant Shares, subject to adjustment. We received total gross proceeds of approximately $15 million from the Private Placement. The Purchase Agreement obligates us to indemnify the Investors and various related parties for certain losses including those resulting from (i) any misrepresentation or breach of any representation or warranty made by us, (ii) any breach of any obligation of ours, and (iii) certain claims by third parties.

The Purchase Agreement contains representations and warranties of us and the Investors, which are typical for transactions of this type. In addition, the Purchase Agreement contains customary covenants on our part that are typical for transactions of this type, as well as the following additional covenants: (i) until Preferred Shares are no longer outstanding, we agreed not to enter into any variable rate transactions; (ii) until following the 180th day after the date the Registration Statement is declared effective, we agreed not to issue or sell any equity security or convertible security, subject to certain exceptions; (iii) we agreed to offer to the Investors, until the later of (x) Preferred Shares no longer outstanding and (y) the Maturity Date, the opportunity to participate in any subsequent securities offerings by us; and (iv) we agreed to hold a stockholder meeting, at which we would use our reasonable best efforts to solicit our stockholders’ affirmative vote for approval of our issuance of the maximum Conversion Shares upon conversion of the Preferred Shares and the maximum Warrant Shares upon exercise of the Warrants, each in accordance with the applicable law and rules and regulations of Nasdaq, no later than October 31, 2023. This Issuance Proposal is intended to fulfill this final covenant.

Preferred Shares

The terms of the Preferred Stock are as set forth in a Certificate of Designations, which was filed with and became effective with the Secretary of State for the State of Delaware on July 14, 2023. The Certificate of Designations was filed as Exhibit 3.1 to the Company’s Current Report on Form 8-K, filed with the SEC on July 13, 2023, and is incorporated herein by reference.

The Preferred Share will be convertible into Conversion Shares at the election of such other person asthe holder at any time at the Conversion Price. The Conversion Price is subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then applicable Conversion Price (subject to certain exceptions). The Conversion Price may also be voluntarily reduced by the Company to any amount and for any period of time deemed appropriate by the Board at any time with the prior written consent of Directors may recommend in that nominee’s place. We have no reason to believe that any nominee will be unable or unwilling to serve as a Director.

The holders of the Preferred Shares are entitled to dividends of 8% per annum, compounded monthly, which is payable in cash or shares of Common Stock at our option, in accordance with the terms of the Certificate of Designations. Upon the occurrence and during the continuance of a Triggering Event (as defined in the Certificate of Designations), the Preferred Stock will accrue dividends at the rate of 15% per annum. Upon conversion or redemption, the holders of the Preferred Shares are also entitled to receive a dividend make-whole payment assuming for calculation purposes that directorthe stated value remained outstanding through and including the Maturity Date. Except as required by applicable law, the holders of Preferred Shares have no voting rights on account of the Preferred Shares, other than with respect to certain matters affecting the rights of the Preferred Shares.

Notwithstanding the foregoing, our ability to settle conversions and make amortization and dividend make-whole payments using shares of Common Stock is subject to certain limitations set forth in the Certificate of Designations, including a limit on the number of shares that may be issued until the time, if any, that our stockholders have approved the issuance of more than 19.99% of our outstanding shares of Common Stock in accordance with Nasdaq listing standards (the “Nasdaq Stockholder Approval”). We agreed to seek stockholder approval of these matters at a meeting to be held no later than October 31, 2023. The Special Meeting is being held and this Issuance Proposal is being submitted to our stockholders in order to achieve Nasdaq Stockholder Approval. Further, the Certificate of Designations contains a certain beneficial ownership limitation after giving effect to the issuance of shares of Common Stock issuable upon conversion of, or as part of any amortization or dividend make-whole payment under, the Certificate of Designations or Warrants.

The Certificate of Designations includes certain Triggering Events (as defined in the Certificate of Designations), including, among other things, our failure to pay any amounts due to the holders of the Preferred Stock when due. In connection with a Triggering Event, each holder of Preferred Stock will be able to require us to redeem in cash any or all of the holder’s Preferred Stock at a premium set forth in the Certificate of Designations.

We are subject to certain affirmative and negative covenants regarding the incurrence of indebtedness, the existence of liens, investment transactions, the repayment of indebtedness, the payment of cash in respect of dividends (other than dividends pursuant to the Certificate of Designations), distributions or redemptions, the transfer of assets and certain minimum cash requirements and establishment of a segregated deposit account for the proceeds of the Private Placement, among other matters.

Warrants

The Warrants are exercisable for Warrant Shares immediately at an exercise price of $2.25 per share (the “Exercise Price”) and expire five years from the date of issuance. The Exercise Price and the number of Warrant Shares issuable upon exercise of the Warrants are subject to customary adjustments for stock dividends, stock splits, reclassifications and the like, and subject to price-based adjustment, on a “full ratchet” basis, in the event of any issuances of Common Stock, or securities convertible, exercisable or exchangeable for Common Stock, at a price below the then-applicable Exercise Price (subject to certain exceptions). Upon any such price-based adjustment to the Exercise Price, the number of Warrant Shares issuable upon exercise of the Warrants will be increased proportionately. The Exercise Price may also be voluntarily reduced by the Company to any amount and for any period of time deemed appropriate by the Board at any time with the prior written consent of the holders of at least a majority of the outstanding Warrants, subject to the rules and regulations of Nasdaq. The Warrants may be exercised for cash, provided that, if there is no effective registration statement available registering the exercise of the Warrants, the Warrants may be exercised on a cashless basis.

Registration Rights Agreement

In connection with the Purchase Agreement, on July 17, 2023, we and the Investors entered into a Registration Rights Agreement (the “Registration Rights Agreement”). Under the terms of the Registration Rights Agreement, we agreed to register on a registration statement (the “Registration Statement”) 200% of the maximum number of Conversion Shares issuable upon the conversion of the Preferred Shares and 200% of the maximum number of Warrant Shares issuable upon exercise of the Warrants. We also agreed to other customary obligations regarding registration, including indemnification and maintenance of the effectiveness of the registration statement. We filed a Registration Statement on Form S-3 for the resale of up to 19.99% of our outstanding shares of Common Stock on August 11, 2023.

Voting Agreement

Certain stockholders, who beneficially held approximately % of our outstanding Common Stock as of the Record Date, are party to a voting agreement (the “Voting Agreement”), pursuant to which, among other things, each such stockholder agreed, solely in their capacity as a stockholder, to vote all of their shares of Common Stock in favor of the approval of the Issuance Proposal and against any actions that could adversely affect our ability to perform our obligations under the Purchase Agreement. The Voting Agreement also places certain restrictions on the transfer of the shares of Common Stock held by the signatories thereto.

Effect of Issuance of Securities

The Preferred Shares are convertible into up to 6,666,668 shares of our Common Stock at the initial Conversion Price, and the Warrants are exercisable into up to 7,200,002 shares of our Common Stock at the initial Exercise Price. The Preferred Shares and the Warrants are convertible and exercisable into up to 6,666,668 shares of our Common Stock at the initial Conversion Price or Exercise Price, as applicable. In the event that the Company in its sole discretion determines to make the accrued dividends and amortization payments in shares of Common Stock and the price per share is less than the Conversion Price, or the Exercise Price is reduced due to the anti-dilution provisions of the Warrants, the number of shares of Common Stock to be issued would be greater than the number of shares at which the Preferred Shares or the Warrants are initially convertible or exercisable. In the event that the Company in its sole discretion determines to make the accrued dividends and amortization payments in shares of Common Stock and the price per share is equal to the Floor Price, or in the event that the Exercise Price is reduced to the Floor Price due to the anti-dilution provisions of the Warrants, the number of shares of Common Stock to be issued would be up to 76,387,283, which number will be increased if the Floor Price is reduced based on the Minimum Price on the date of the Stockholder Approval. The potential issuance of Underlying Shares would result in an increase in the number of shares of Common Stock outstanding, and our stockholders will incur dilution of their percentage ownership to the extent that the investors convert their Preferred Shares or exercise their Warrants, or additional shares of Common Stock are issued pursuant to the dividend and amortization terms or anti-dilution terms of the Preferred Stock or the Warrants, as applicable. Because of potential adjustments to the number of shares of Common Stock issuable upon conversion of the Preferred Stock and exercise of the Warrants issued in connection with the Private Placement, the exact magnitude of the dilutive effect of the Preferred Stock and Warrants cannot be conclusively determined. However, the dilutive effect may be material to our current stockholders.

Proposal to Approve the Private Placement